An Unbiased View of Offshore Company Management

Wiki Article

Little Known Questions About Offshore Company Management.

Table of Contents3 Simple Techniques For Offshore Company ManagementThe Best Strategy To Use For Offshore Company ManagementThe Only Guide to Offshore Company ManagementSome Ideas on Offshore Company Management You Need To Know

This is since the firm is registered in a different territory that is usually beyond the reach of tax authorities or rivals. If you are in the United States, yet sign up the firm in a territory like Seychelles or Belize, you can relax ensured that your data is protected.You will certainly not be subjected to the very same tax obligation prices as domestic companies, so you can save a great offer on taxes. The jurisdictions where offshore firms are typically signed up often have dual tax treaties with other nations.

An offshore firm is likewise more adaptable relating to regulations and also compliance. The regulations in the jurisdiction where you sign up the firm might be much less rigid than those in your house country, making it much easier to establish the firm as well as run it without way too much documents or legal headache. You will additionally have fringe benefits, such as using the business for international trade.

This is due to the fact that the company is signed up in a jurisdiction that might have more versatile property security regulations than those of your home country. As an example, if you choose the ideal territory, lenders can not conveniently confiscate or freeze your overseas possessions. This makes sure that any kind of cash you have actually purchased the company is risk-free and also secure.

Getting My Offshore Company Management To Work

Offshore companies can be used as cars to safeguard your assets versus possible complaintants or lenders. This suggests that when you pass away, your beneficiaries will inherit the assets without disturbance from financial institutions. It is vital to seek advice from a legal professional before setting up an overseas firm to make sure that your possessions are properly shielded.Offshore jurisdictions usually have less complex demands, making completing the enrollment process and running your organization in no time at all a breeze. In addition, a lot of these territories supply online incorporation solutions that make it a lot more practical to register a business. With this, you can rapidly open up a company bank account in the jurisdiction where your business is signed up.

You can quickly transfer funds from one bank account to an additional, making it easier to handle and move money around. When running a service, the risk of lawsuits is always existing. However, setting up an offshore company can aid reduce the possibilities of being filed a claim against. This is because the legislations in lots of territories do not allow foreign firms to be sued in their courts unless they have a physical presence in the country.

3 Simple Techniques For Offshore Company Management

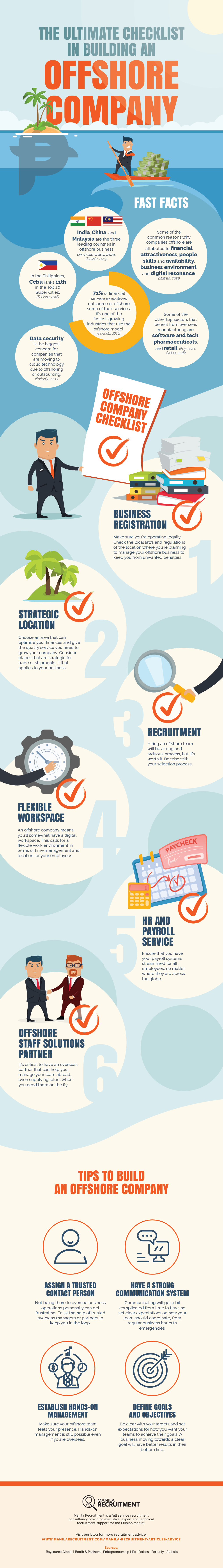

Establishing a company in another country can be fairly simple. There are many nations that offer advantages to companies that are aiming to establish up an overseas entity. Several of the benefits of an overseas company consist of tax advantages, privacy as well as confidentiality, legal defense and property protection. In this blog site we will certainly check out what an offshore business is, positions to consider for optimal tax obligation benefits and additionally overseas consolidation as well as established.

Lots of nations provide tax benefits to firms from other countries that transfer to or are integrated within the territory. Business that are formed in these overseas territories are non-resident due to the fact that they do not perform any financial transactions within their borders and are possessed by a non-resident. If you desire to establish an overseas business, you must utilize a consolidation agent, to guarantee the documents is completed correctly and you get the ideal suggestions.

Contact your development representative, to ensure you don't damage any type of limitations in the country you are forming the company in around safeguarded firm names. why not try here Produce the short articles of association - examine with your formation agent, whether these demand to be typical or bespoke. Take into consideration share funding and financing. Think about the kinds of shares the business will certainly provide.

Fascination About Offshore Company Management

Offshore company frameworks might hold an unique standing that makes them non reliant local domestic taxes or are required to pay taxes on their around the world earnings, funding gains or earnings tax. offshore company management. If your offshore find out here business is importing or exporting within an offshore place, for instance, getting orders straight from the customer and the purchased goods being sent from the producer.

For UK locals, offered no amounts are remitted to the United Kingdom, the resources and also revenue gained by the overseas business stay tax-free. Tax obligations usually are established by the nation where you have long-term residency in and also as beneficial owners of a business you would certainly be accountable to be tired in your country of residence - offshore company management.

Tax obligation commitments differ significantly from country to nation so its vital to make certain what your tax obligations are prior to selecting a jurisdiction. Offshore business are only based on UK tax on their profits emerging in the UK. Also UK source rewards paid to an overseas company needs to be complimentary of tax.

Report this wiki page